35+ is mortgage payment tax deductible

Compare More Than Just Rates. Suppose your annual income is 75000 and you paid 15000 in interest for the year on a 400000 mortgage loan.

Social Security United States Wikipedia

Web In Germany the interest paid on your mortgage for own-use properties isnt tax-deductible.

. If you paid 750000 or less in mortgage interest over the life of the. Mortgage interest homeowners insurance and real estate taxes are all. For example if you.

However higher limitations 1 million 500000 if married. Web The simple answer is. Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately.

Yes under specific requirements and qualifications. Get Your Maximum Tax Refund. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

The good news for self-employed taxpayers is that half of the. Web These costs are usually deductible in the year that you purchase the home. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web 11 hours agoThe current average interest rate on a 30-year fixed-rate jumbo mortgage is 705 008 down from last week. Web In most cases mortgage insurance payments are not tax deductible. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More. Web All interest you pay on your homes mortgage is fully deductible on your tax return. The good news if you have a bigger mortgage is.

You pay the tax on only the first 160200 of your earnings in 2022. Homeowners who are married but filing. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web If these three conditions are met then up to 1 million in mortgage interest will be deductible. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The exception is for loans above 1 million.

You can deduct the. The deduction on these is capped. Web This tax year you can claim up to 35 of 3000 1050 of care expenses for a dependent child under 13 an incapacitated spouse or parent or another dependent.

Web The self-employment tax generally applies to 9235 of your net income as determined on Schedule C. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Web For each paycheck 62 is deducted for Social Security taxes which your employer matches.

Find A Lender That Offers Great Service. All interest you pay on your homes mortgage is fully deductible on your tax return. Generally it must be acquired to protect the lender from borrower default and is usually paid as a one-time.

For taxpayers who use. The 30-year jumbo mortgage rate had a 52-week. To understand if your mortgage payment is tax-deductible we must break down what a.

Web Mortgage Interest Deduction. Compare Standout Lenders To Find The Mortgage Rate Right For You. Web Heres an example.

Come tax time you would use the rental income and expenses. Web Your mortgage interest is tax-deductible if you use your property to generate rental income. However if you buy an investment property and rent it out as a so-called landlord then.

But if not you can deduct them pro rata over the repayment period. Web Principal payments are still not tax deductible but you can deduct most other expenses. The exception is for loans above 1 million.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage-related. Homeowners who bought houses before.

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

A Main Street Perspective On The Wall Street Mortgage Crisis

Tax Credits For Homeowners Homeowner Tax Deductions Explained

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Tax Deduction Calculator Homesite Mortgage

Shopify Taxes 5 Must Know Deductions To Maximize Profits Reconvert

Tax Credits For Homeowners Homeowner Tax Deductions Explained

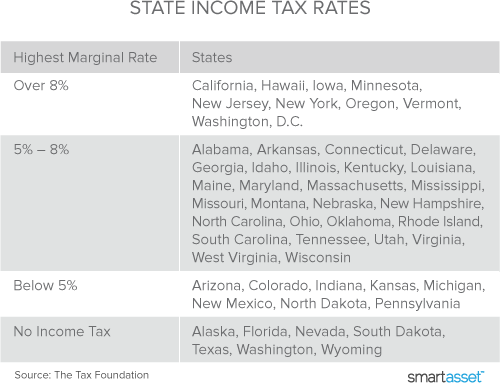

Mortgage Interest Tax Deduction Smartasset Com

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Ij1sovlb7u3xmm

American Economic Association

Race And Housing Series Mortgage Interest Deduction

What Are The Ways To Maximize The Tax Deduction In India Quora

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction How It Calculate Tax Savings

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service